stockcharts Investor insights

Get Paid to Buy Your Favorite Stocks

Key TakeawayS

- Selling cash-secured puts allows you to generate consistent income and own stocks at a discount.

- The OptionsPlay Add-On for StockCharts simplifies the process of identifying the optimal strategy.

- Learn how to generate income and streamline your options process using this tool.

Table of conTentS

Most investors are familiar with buying stocks — place a limit order and wait for the price to hit a specific level before getting filled. But, instead of buying stocks, what if you could get paid to wait for the stock to fall to exactly the price you want?

That’s the power of selling cash-secured puts, an income strategy that institutional traders, hedge funds, and financial advisors use to acquire stocks at a significant discount. Instead of earning nothing while waiting for the stock to reach your entry point, a short put gives you immediate income, and, if the stock drops, you buy it at the price you wanted, i.e., the strike price, with a discount.

In theory, the short put strategy is simple and can be highly effective when executed correctly. Plus, with the OptionsPlay Add-On for StockCharts, you can automate the entire process of finding the best stocks to buy, selecting the optimal expiration date and strike price, through risk and yield analysis.

In this market environment, it’s common for investors to start thinking about picking up stocks at bargain prices. Before rushing to own a piece of those stocks, it’s worth investing a few precious minutes to look at what’s brewing below the surface.

What is a Short Put Strategy?

A short put, or cash-secured put, involves selling a put option on a stock you’re willing to own and setting aside enough cash to buy 100 shares if the stock is assigned. When you get assigned, you are obligated to buy the underlying 100 shares. You get paid a premium upfront, and the following two outcomes can occur:

If the stock stays above the strike price at expiration, the option expires worthless, and you keep the full premium as profit. You can then choose to sell another put and generate further yield.

If the stock falls below the strike price, you’ll be obligated to buy the stock at that price. In other words, you own the stock at your desired entry point, plus the premium you already received.

Why Use This Strategy?

Generate consistent income

You can earn attractive yields on high-quality stocks that may not yet be at your buy target.

Own stocks at a discount

If assigned, you’re buying the stock below today’s price and below your original target.

Higher probability of profit

With out-of-the-money puts, you can be wrong on direction and still come out ahead.

Best Practices forShort Puts

Stock Selection

Stick with liquid, high-quality names you’d be comfortable owning in a downturn. Avoid highly volatile or illiquid names, especially those with binary catalysts such as FDA announcements.

Expiration Date

A 30-day expiration tends to offer the best balance of income received vs. total risk. Shorter-dated options may not provide enough premium; longer-dated options tie up your capital for too long without sufficient added benefit.

Strike Price Selection

A good rule of thumb is to sell a 30–40 Delta put — this typically sits just below the current price, offering a high probability of owning the stock, while generating maximum income.

Yield Consideration

Look for short puts that offer at least 15–20% annualized yield on capital at risk. This provides enough cushion for time decay and assignment risk while generating meaningful returns if repeated monthly.

Entry Timing

Avoid selling short puts on days of elevated volatility or during earnings week. Instead, look for setups when implied volatility is slightly elevated but stable. This boosts the premium received.

Exit Strategy

If the option declines significantly in value with two to three weeks before expiration (e.g., you’ve captured 70–80% of the premium), consider closing early and redeploying capital into a new trade. If assigned, be prepared to own the stock and potentially sell covered calls to generate further income.

Glossary

New to options and want more information? The StockCharts Options Glossary is your go-to resource for understanding the strategies mentioned here.

Why This Strategy is Difficult to Execute Manually

The reality is that this strategy requires constant scanning of thousands of option chains to identify the best yield, expiration, strike price, and technical alignment.

Even if you're proficient with options, the manual process is time-consuming and introduces human biases:

- How do you rank the best short puts across all stocks?

- How do you calculate the yield and probability of assignment?

- How do you know if the strike aligns with a technical support level?

This is where the OptionsPlayAdd-On for StockCharts becomes indispensable.

How OptionsPlay Automates the Process

The OptionsPlay Add-On for StockCharts takes the guesswork and manual labor out of selling puts. Here’s how:

Real-Time Rankings

The add-on instantly scans all liquid U.S. stocks and ranks short put opportunities by annualized yield.

Optimal Strike & Expiration

Automatically identifies the 30-day, 40-Delta put for each stock, the sweet spot for income and risk.

Technical Confirmation

Every idea includes visual charts showing if the strike price aligns with recent support levels.

Probability Metrics

You’ll instantly see the estimated probability of profit, downside cushion, and breakeven price.

Custom Watchlists

Scan your own StockCharts ChartLists for put-selling opportunities across the stocks you follow.

Learn How It Works – In Under 3 Minutes!

If you're serious about generating income and want to streamline your options process, this is the tool designed for you.

The OptionsPlayAdd-On for StockCharts is just $40/month, and we’re confident that even one quality trade a month can justify the full annual cost. This tool is already helping thousands of investors systematically generate yield on their terms.

Let us show you how we can help you generate enough value to make OptionsPlay a core part of your income strategy.

Watch this quick video to see how it works ↓

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

Smarter investing is just one click away!

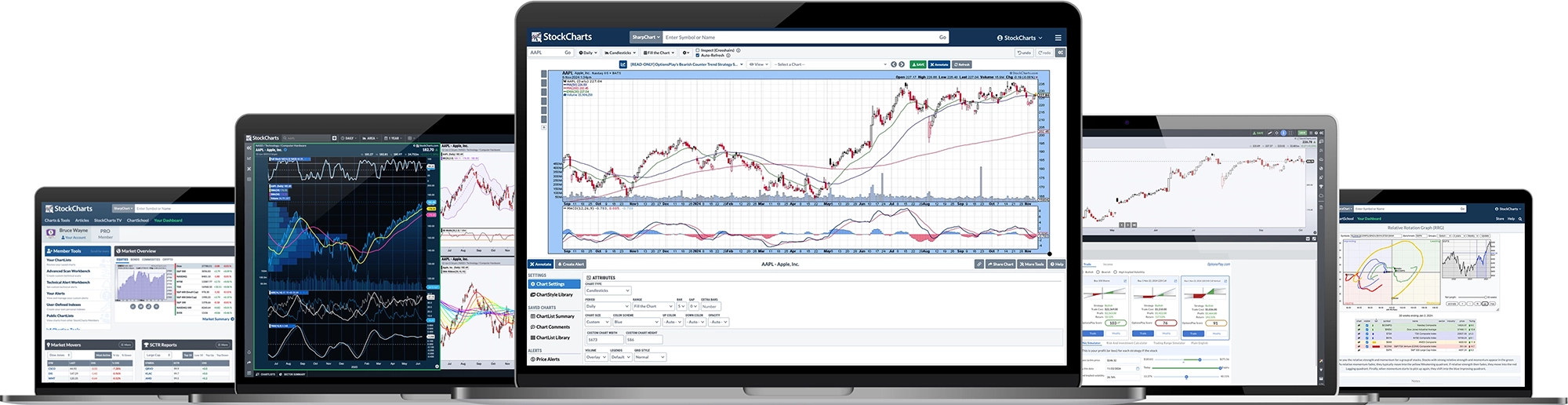

Feeling confident about your investment decisions can be difficult. We get it. At StockCharts, we're investors too. StockCharts was founded 25 years ago to help investors cut through the noise of the markets using the best market data, technical charts, and trading analysis tools in the world.

StockCharts.com helps investors and traders adjust for market shifts and volatility.

Our award-winning flagship product, SharpCharts, is the gold standard for online technical analysis. SharpCharts provides you with an intuitive and comprehensive set of tools to analyze market trends and make informed trading decisions.

Create large, advanced charts

Real-time Intraday Data

Technical Indicators and Overlays

Auto-refresh

Candlesticks, lines, bars, and much more

Millions of investors trust StockCharts.com to deliver the tools and resources they need.

Here’s what a few have to say about us:

"I have learned a lot over the past 5 years and have carved out a style of trading that is within my risk threshold and provides me a way to find excellent setups with terrific risk-reward. I owe StockCharts a debt of gratitude for building such a robust system... Thanks again!"

-LG.

The more I read and study from trading pros, the more I appreciate all of the wonderful tools available on your website. I’m becoming a smarter and “better-educated trader” as I continue learning from your seasoned experts, videos, and trading tools. Trading is no longer a hobby. It’s now a part-time home-based business for me. Thank you all for what you do.

-JK.

Our Charts Have Been Seen On